Summary

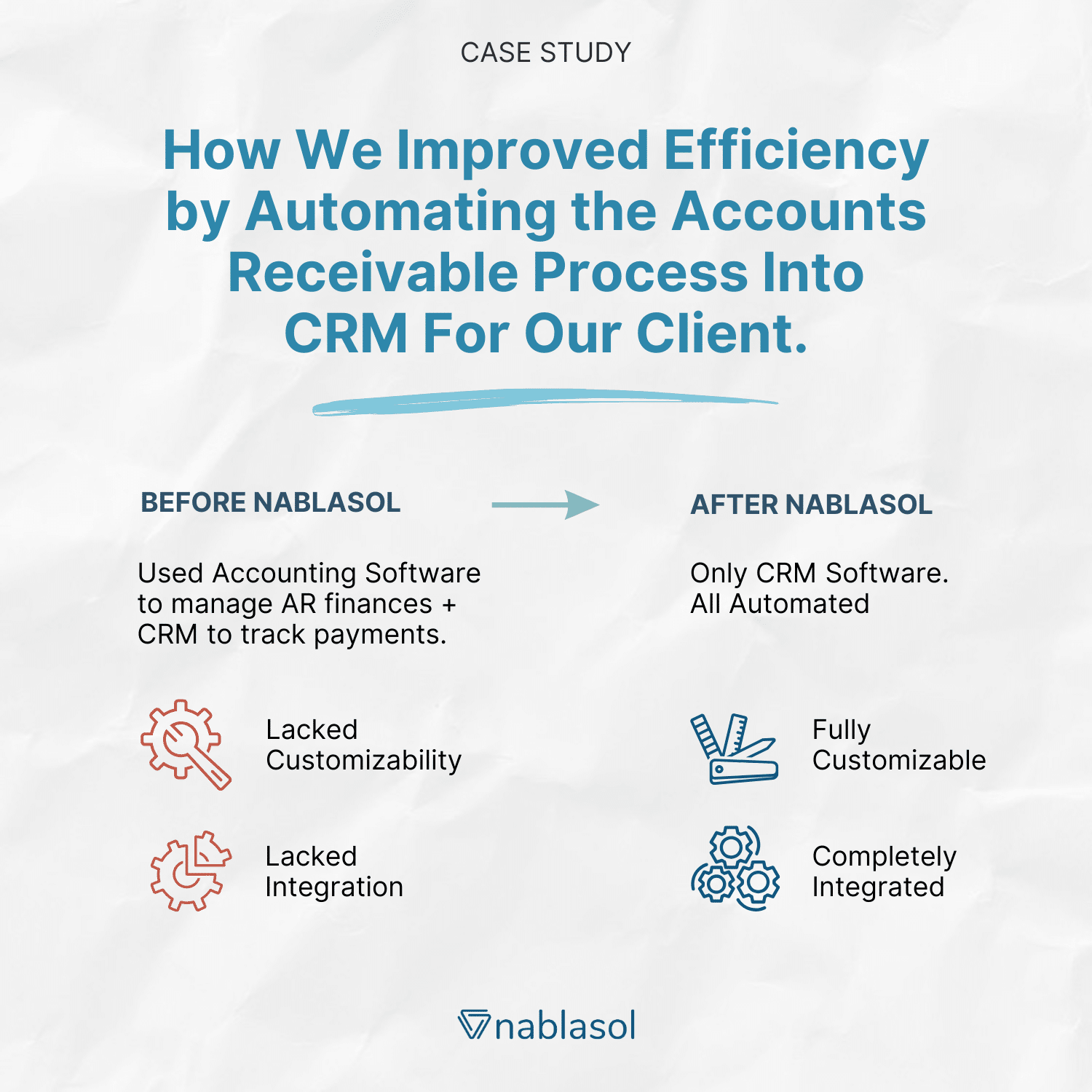

Any workflow that helps a company increase profit must be prioritized and made as efficient as possible. Clean financials speak volumes for any business. It makes Accounts Receivable one of the most critical business functions. Our Tax Service client wanted to make the AR process more efficient to avoid errors and ensure deliverables. We helped them automate their unique business workflow to make it more efficient and improve the overall Accounts Receivable workflow.

Business Challenges:

The Accounts Receivable workflow deals with the cash inflow related to the customers and related payment processes across the customer journey. Our Tax Service client was using Accounting Software to manage finances. But the customizability and integration required to make an efficient Accounts Receivable process were missing from it.

Generally, accounting softwares are more report-centric. Although they have payment integrations and customer invoicing features, unique processes specific to service-based companies like automated commission calculation for the sales team are usually not present.

Our client was unable to trace payments and attribute them to a particular service. The calculation of sales commission and attributing them to the different sales executives had become a severe issue that needed to be solved quickly. The lack of a proper collection process of commissions was hurting the company from a financial and workflow standpoint.

Some of the features under the payment processes window, like recurring payment, payment approvals, and segregation of payment by business unit, were essential in their workflow. It was important for our client since they had three different business units running simultaneously. The AR department was manually adding and scheduling payments after getting approval requests from the sales team. The lack of a proper Accounts Receivable process was mounting up problems day after day.

We empowered the AR department with an advanced system to manage their daily business operations. They can collect client payments, track payments, send out customer invoices and calculate sales commissions through the CRM they use itself.

Here is a list of all the features we have developed for our client as tools under the Accounts Receivable Automation:

- Billing & Invoicing – Generating custom invoices, receipts, quotes, billing statements, and other payment-related documents.

- Standard and Recurring Payments – AutoPay directly carries out a recurring payment process.

- Payment Process Automation – Create payment drafts and schedule for later.

- Payment Gateway Integrations – Credit Card, ACH, Loan Providers

- Sales Commissions Generation and Tracking

- Billing and AR Reporting – Payments as per business unit are segmented.

- Refunds, Billing Adjustments, and Payment Reversals – Track billing history and built-in reminders.

Some of the more general features applicable to various other industries are:

- Integration of Credit Card Processes.

- Integration of Automatic Clearing House in the payment gateway.

- Association with Lenders and Loan Service Providers

Impact on Business

Our client still has an Accounts Receivable department but is only responsible for overseeing the payment processes. The AR processes now work efficiently as an automated payment collection engine. Their CRM system is now a much more powerful tool with payment-related capabilities.