Data is the lifeblood of decision-making in today’s hectic financial scene. Document management systems (DMS) are helping companies simplify processes as economic data from many sources becomes more complex. These systems are developing into potent instruments that allow enhanced data aggregation, real-time insights, and strategic analytics rather than only file storage.

The Growing Demand for Integration of Big Data Into Financial Management

Financial institutions and companies handle enormous volumes of data daily. The range and volume of material can be taxing, from invoices and receipts to compliance records and audit trails. Historically, controlling such data has been a labor-intensive task prone to mistakes.

Big data analytics provides one transforming solution. It lets companies use enormous volumes of structured and unstructured data to create valuable insights. Still, document management solutions will be the secret to releasing this promise.

Documentation Systems Enhance Data Aggregation

Modern DMS systems connect with accounting tools, customer relationship management (CRM), and Enterprise Resource Planning (ERP) systems, among other software items. These links guarantee perfect data gathering from many sources.

Examples

- A DMS simplifies data access and analysis by grouping financial information, contracts, and compliance documentation into one platform.

- By aggregating data in real-time, document management systems help minimize disparities, sometimes resulting from several storage options.

- Cloud-based DMS systems let authorized staff members access and examine data from anywhere, guaranteeing decision-making effectiveness.

- Combining all these components, DMS solutions streamline the foundation for big data analytics.

Modern Analytics Made Possible by Document Management Systems

Analytics is the actual worth of extensive data. Modern tools in document management systems enable the extraction of significant trends and insights. They help this as follows:

1. Tagging and Intelligent Categorization

DMS driven by artificial intelligence can automatically classify and tag documents based on their content. For instance, an invoice might be categorized under “expenses,” while a tax document might fit under “compliance.” This functionality speeds up data organizing and retrieval.

2. Real-Time Observations

Real-time data integration helps companies make quicker, wiser decisions. Using DMS insights, a financial manager may, for example, rapidly examine monthly costs, see trends, and suggest budget changes.

3. Tools for Data Visualisation

Many document management systems today provide built-in dashboards that display data in aesthetically pleasing forms. Tables, graphs, and charts help interested parties quickly understand complex data sets.

4. predictive analytics

Advanced analytics technologies inside DMS project future trends using past data. Analyzing historical transactions, for instance, would help a business forecast possibilities for investment or cash flow constraints.

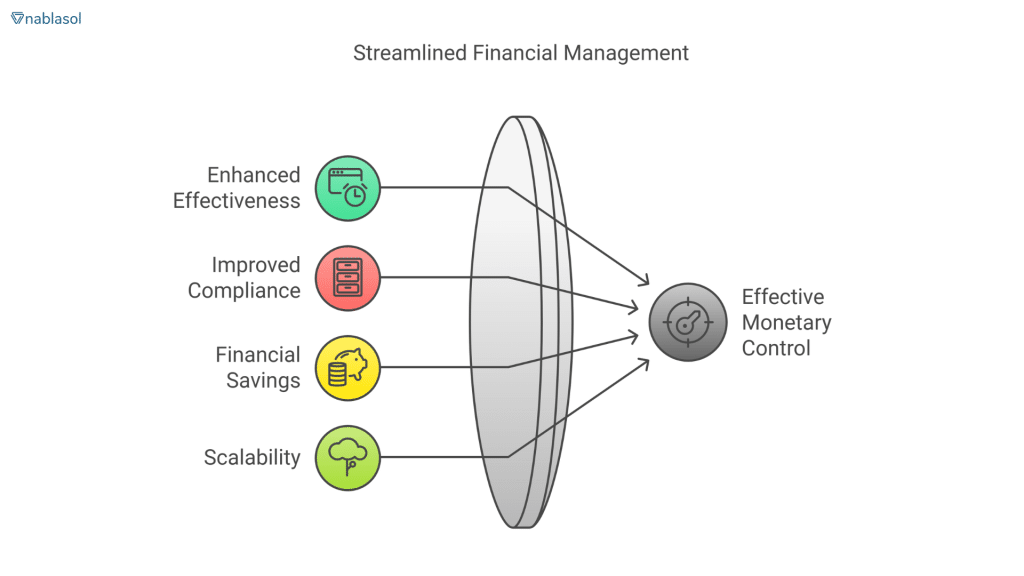

Essential Advantages for Monetary Control

Extensive data analytics implementation of document management systems has many benefits:

1. Enhanced effectiveness

Automating data collection and analysis helps a DMS save time on labor-intensive chores, freeing financial teams to concentrate on strategy.

2. Improved Following Compliance

Regulative compliance is an essential component of financial management. A DMS provides security for documents and guarantees their accessibility for audits, reducing non-compliance risks.

3. Financial Savings

DMS tools’ precision and efficiency translate into substantial financial savings. Lowering mistakes and better resource allocation directly affect the bottom line.

4. Scalability

Businesses expand alongside their data. Scalable solutions provided by cloud-based document management systems allow us to meet growing data requirements without interfering with processes.

Getting Beyond Implementation Difficulties

Although adopting DMS for analytics and big data has benefits, several difficulties could be improved. Knowing and removing these obstacles guarantees efficient implementation:

Problems with Data Movement: Turning old data into a DMS can take time. A well-considered relocation plan is essential.

Integration Complexities: Not every DMS system perfectly interacts with current systems. One must select a platform with solid integration capacity.

Training Call to Order: Staff members could need training to use the system’s functionality effectively. Giving support and conducting practical seminars will help simplify this procedure.

Practical Applications Case Study: SMEs’ Expense Management

To handle its financial records, a tiny company used a cloud-based DMS.

The business attained by tying the system into its accounting program:

- 30% quicker invoice processing times.

- Real-time analysis of expenditure categories enables them to spot chances for cost control.

- Banking Risk Management Case Study

- Using its DMS for risk analysis and compliance, a mid-sized bank found Advanced analytics enabled the university to spot high-risk transactions, lowering its financial fraud exposure.

The Future of Document Management Systems in Big Data

The synergy between document management systems and big data is poised to grow. As technology advances, we can expect DMS to feature:

- Enhanced AI Capabilities: From sentiment analysis in financial reports to anomaly detection in transaction data, AI will deepen the analytical potential of DMS.

- Blockchain Integration: Blockchain can ensure the authenticity and traceability of financial documents, further enhancing trust.

- Increased Personalization: Tailored dashboards and insights based on user roles will make DMS more versatile for diverse financial teams.

Final Thoughts

Document management systems are now necessary in the era of big data, not optional. These technologies enable financial professionals to make informed, quick judgments by serving as a link between advanced analytics and data storage.

DMS technologies are changing the financial management scene. From real-time insights to workflow simplification, organizations that continue to adopt this technology will have unprecedented opportunities for efficiency and expansion.

Investing in a robust DMS now is about laying a basis for more creative, data-driven decision-making, not only about organizing papers.