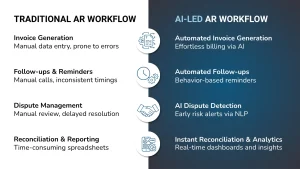

Artificial intelligence is emerging as the foundation of next-generation accounts receivable (AR) systems as companies scramble to modernize their financial operations. AI is advancing real-time decision-making, predictive insights, and workflow efficiency across industries; it is no longer merely a tool for automation. The global AR automation market hit $3.81 billion in 2023 and is set to grow at a 12.9% CAGR through 2030, signaling strong momentum in digital finance transformation.

AI-powered AR is becoming especially valuable for businesses dealing with tax debt, IRS notices, and compliance-sensitive receivables. These cases demand accuracy, speed, and proactive risk management – areas where AI excels. From automating follow-ups to identifying high-risk accounts, intelligent AR systems are helping finance teams stay ahead of deadlines, reduce exposure, and confidently navigate complex regulatory challenges.

The Strategic Role of AI in Account Receivable

Accounts Receivable has shifted from a routine task to a strategic financial lever. With AI, AR now supports broader goals – enhancing cash flow visibility, reducing risk, and improving compliance, particularly for complex or time-sensitive receivables.

In fact, 80% of businesses using automated AR software report improved efficiency in their accounting processes, underscoring AI’s impact beyond simple automation.

AI enhances forecasting accuracy, helping finance teams predict cash inflows, identify high-risk accounts early, and prioritize collections effectively. Beyond streamlining processes, it transforms AR into a strategic asset that drives long-term financial health and accountability.

AI Technologies Used in Account Receivable

Modern AR is no longer just about collecting payments—it’s about predicting behavior, orchestrating intelligent workflows, and maintaining frictionless engagement. Here’s how leading AI technologies are powering that transformation:

Predictive Risk Segmentation with Machine Learning (ML)

Advanced ML models enable dynamic customer segmentation by analyzing real-time payment behavior and risk, driving smarter strategies like optimized reminders and tailored terms for targeted, effective collections.

Large Language Model (LLM) Powered NLP Automation

LLM-driven NLP processes unstructured information such as emails and support tickets for sentiment, intent, and urgency detection, allowing for early detection of financial risks, disputes, and compliance issues to make quicker, better decisions.

Intelligent Workflow Orchestration with AI Agents

AI Agent bots streamline the AR lifecycle by automating tasks like invoicing, payment matching, and reconciliation in real time. They reduce errors, ensure compliance-ready documentation, and free up AR teams for exception handling and strategic work.

AI-Driven Predictive Analytics

AI predictive models give finance teams clear visibility into liquidity, cash flow, and payment risks, enabling proactive action, preventing shortfalls, and guiding smarter credit and collection decisions.

Hyper-Personalized Omnichannel Engagement via Conversational AI

RPA robots simplify the AR process by eliminating manual processing of work such as invoicing, payment matching, and reconciliation in real time. They minimize errors, provide compliance-ready documents, and free up AR staff for exception handling and strategic activities.

Benefits of having AI in Account Receivable

Adopting AI in Accounts Receivable isn’t just about modernization—it’s about unlocking measurable gains across cost efficiency, cash flow, compliance, and client experience. Here’s how AI elevates AR performance:

Efficient Processes & Reduced Costs

AI simplifies primary AR processes such as invoicing, payment follow-up, and reconciliation. Through minimizing manual touch and automating repetitive functions, organizations obtain considerable time and cost savings to enable more strategic work by finance departments rather than running after payments.

Improved Cash Flow & DSO Reduction

Through predictive modeling, AI analyzes payment trends and customer behavior to optimize collection timing. This leads to more effective follow-ups, faster payments, and a measurable drop in Days Sales Outstanding (DSO) – improving liquidity and working capital.

Enhanced Accuracy

AI minimizes the risk of human error in critical processes such as data entry, account matching, and financial reporting. This not only improves accuracy and auditability but also builds trust across internal teams and external stakeholders.

Compliance Readiness

For firms handling tax resolution or government-related receivables, compliance is non-negotiable. AI ensures automated documentation, audit trails, and deadline tracking, reducing the risk of non-compliance and easing the burden of regulatory complexity.

Enhanced Customer Experience

AI-powered chatbots and intelligent reminders offer personalized, timely communication, from answering FAQs about tax deadlines to sending payment nudges based on behavior. This results in smoother interactions, quicker resolutions, and stronger client relationships.

Executing AI Transformation in Accounts Receivables

Successfully integrating AI into AR requires a thoughtful approach that prioritizes data integrity, compliance, and client-specific strategies. Here’s a streamlined roadmap:

Assess Current AR Workflows

Find inefficiencies, manual hotspots, and opportunities for automation, particularly those involving compliance-intensive receivables.

Establish Strategic Objectives

Establish specific objectives such as reducing DSO, enhancing forecasting, or lessening regulatory risk. Align with more comprehensive financial and operational priorities.

Ensure Data Readiness

Clean and standardize AR data for accuracy. Integrate sources to build a centralized view that supports intelligent segmentation and analytics.

Choose the Right AI Tools

Select technologies that align with your goals, e.g., ML for risk forecasting, NLP for communication insights, and RPA for workflow automation.

Pilot and Iterate

Start with a pilot program to test AI solutions on a small scale. Gather feedback and make necessary adjustments before full-scale deployment.

Empower Your Team

Train staff on AI capabilities and compliance protocols. Provide ongoing support to ease adoption and maximize value.

Monitor, Measure, Optimize

Track performance against KPIs. Continuously adjust AI models and workflows to improve outcomes and ensure regulatory alignment.

Challenges with AI in Accounts Receivable

Data Quality and Integration

AI systems rely heavily on high-quality, structured data. Inconsistent or incomplete data can lead to inaccurate predictions and insights. Integrating AI with existing legacy systems can also be complex, requiring significant time and resources.

Change Management and User Adoption

During the implementation process, existing workflows and processes have to be readjusted in most cases. Employees may resist the incorporation of new systems because they do not understand them or fear job displacement. Effective strategies and comprehensive training are very important in putting in place user adoption.

Data Privacy and Security Concerns

Handling sensitive financial data with AI systems raises concerns about data privacy and security. Ensuring compliance with data protection regulations and implementing robust security measures are critical to prevent data breaches and maintain customer trust.

High Implementation Costs

Medium and large enterprises may see huge benefits from the investment over time. However, even for them, success depends on choosing the right AI tools, change management, and ensuring alignment with existing finance workflows.

Regulatory Compliance and Ethical Considerations

AI systems must comply with various financial regulations and ethical standards. Ensuring transparency, fairness, and accountability in AI-driven decisions is essential to avoid regulatory penalties and maintain ethical integrity.

Choosing the Right Account Receivable AI Software

Define Your Needs

Start by identifying your current AR challenges, such as delayed payments, high DSO, or manual processing bottlenecks. Then, establish clear objectives for AI integration, whether it is improving cash flow forecasting or streamlining invoice workflows.

Check Key Features

Look for automation capabilities that cover invoice generation, payment reminders, and cash application. It should also use AI in predictive analytics, risk scoring, and intelligent customer communications.

Prioritize User Experience

The platform should have an intuitive, user-friendly interface that your team can quickly adopt. It should also offer customization options for workflows, reports, and dashboards to match your specific operational needs.

Evaluate Vendor Credibility

Strong customer support is critical. Research their reputation through client reviews, case studies, and any industry recognition.

Assess Cost & ROI

Understand the full pricing structure, including setup, subscriptions, and any hidden fees. Estimate the potential ROI by considering cost savings, reduced manual effort, and overall efficiency improvements.

Real-World Case Study: AI Drives AR Efficiency

In one example, a tax service client struggled with tracking payments, attributing them to the correct services, calculating commissions, and managing approvals across multiple business units—issues that led to inefficiency and frequent errors.

By partnering with Nablasol to automate their accounts receivable process through a customized CRM integration, the client was able to streamline payment tracking, automate invoice generation, and simplify commission calculations and approvals.

This automation drastically reduced manual effort, minimized mistakes, and significantly improved the accuracy and efficiency of their financial operations, showcasing the transformative benefits of AR process automation for complex service-based businesses.

Want to learn more about this transformation? Explore the detailed case study here.

Conclusion

AI is no longer a future-forward concept; it’s a present-day solution reshaping how businesses manage Accounts Receivable. From improving forecasting accuracy and automating manual tasks to reducing risk and enhancing compliance, AI enables AR teams to move beyond collections and become proactive drivers of financial performance.

For industries dealing with complex receivables, especially those tied to government debt, tax settlements, or regulatory timelines, AI provides a critical edge. It helps ensure payments stay on track, communications are timely and compliant, and data is audit-ready at all times.

The path from strategy to execution doesn’t have to be overwhelming. With the right tools and a clear roadmap, transforming AR operations with AI is both achievable and impactful.

Frequently Asked Questions

How can AI be used in accounts receivable?

AI can automate repetitive AR tasks such as invoice generation, payment reminders, and cash application. It also predicts payment trends, identifies high-risk accounts, and optimizes collection strategies.

What is generative AI in accounts receivable?

Generative AI in AR refers to advanced models that process unstructured data, such as emails or support tickets, to detect payment risks, automate customer communications, and generate personalized responses.

Can accounts receivable be automated?

Yes, many aspects of AR can be automated using AI, including invoicing, payment matching, follow-ups, and reporting. Automation reduces manual errors, speeds up collections, and improves cash flow management.

What is the role of machine learning in accounts receivable?

Machine learning automates invoice processing, predicts late payments, analyzes customer payment patterns, and optimizes collection strategies in accounts receivable.

How do I choose the right AI-powered AR software?

Define your AR challenges, look for features like automation, predictive analytics, and seamless integration with existing systems, prioritize user experience, evaluate vendor credibility, and assess the potential return on investment.